SHERRYL and Spencer Blowfield live in Didcot with their three children, Peter, 13, Georgia, 11, and Daniel, eight.

Mrs Blowfield, 35, is a self-employed childminder and Mr Blowfield, 36, works at BMW’s Mini car plant in Oxford.

Mrs Blowfield said that the Chancellor’s decision to increase VAT and reduce child tax credits was a ‘double whammy’ for families.

She added: “The reduction in child tax credits is going to hit us, as we’re a middle income family.

“The little bit we get through the tax credit is small but it helps, of course.”

But she welcomed the changes to income tax.

She said: “I’m a self-employed childminder and I don’t earn a great deal, so raising the tax threshold is good, as I won’t pay as much tax on the little I earn.”

She said increasing the retirement age would not be an issue for her, adding: “Because of the tax going up, we’re going to be working into our 70s if we’re able.”

Mrs Blowfield was also worried about the impact of the cuts in Government and council spending.

She said: “With the public sector cuts, everything around the town is going to be affected.

“The policing will be affected and we won’t see as many of them about.”

- Pensioners John and Carol Scully live in Cowley, Oxford.

Mr Scully is a retired car worker and county council caretaker and Mrs Scully worked as a secretary.

Mr Scully, 71, said; “I don’t think they have done anything for the pensioner.

“We have just had to have the house rewired and if I had had to have that done next year it would have cost a lot more. The pension rise comes in next April but the VAT is in January.”

Mrs Scully, 67, added: “One thing we noticed was the tax allowance for under-65s is going up, but nothing was mentioned on pensioners. My husband has two small company pensions and that takes him into the tax bracket.”

- Sam Cunningham, 31, lives in Blackbird Leys with her 11-year-old daughter Caitlin, and is a full-time mother.

Miss Cunningham said: “The VAT rise isn’t good. My daughter is off to secondary school and it’s just more cost. As she gets older VAT does affect more things, as they end up in adult clothes.”

She agreed that lone parents should return to work once their child reached school age, but said that was not as easy as Mr Osborne made it sound.

She said: “I’m going back to work, so I welcome the rise in the income tax threshold. But it’s hard to find something, because there’s not a lot around.”

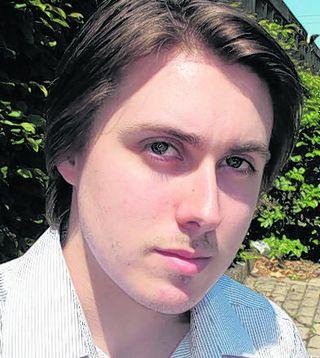

- Adam Wakeling, 24, from Oxford, is about to complete a masters degree in publishing at Oxford Brookes University.

He said: “I feel fortunate that I am graduating just before the 25 per cent education spending cut the Government has proposed.

However, Mr Wakeling said he understood the Government had to make difficult decisions in these tough economic times, but added: “Universities are an easy target for cuts to reduce the deficit, but that cost will be picked up by a generation of students facing a lower quality of teaching for as long as the cuts remain.”

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here